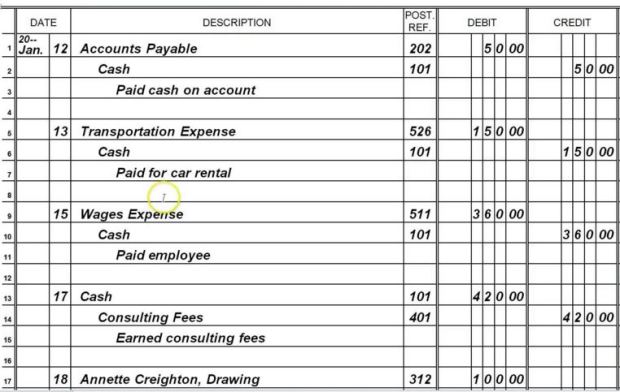

Trying to remember why entries are recorded based on a ledger is hard. That is why there is something called a general journal. A general journal is also called a book of original entry. Of course the name explains it all. Each transaction is recorded in the general journal first. It includes the account debited and credited as well as an explanation. There will be no way to forget what each transaction is.

The month and year of the transactions are not necessarily recorded each time. Only the day of the transaction is recorded each time no matter how many transactions there are on that day. The month and year are only necessary if the month/year has changed.

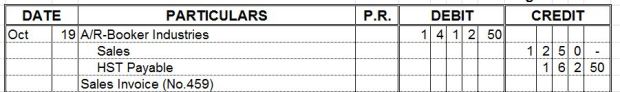

Something to remember about when recording entries in a general journal is that the debit account is always recorded first, then the credit account. The credit account must be indented! Explanations can be as simple as “Paid full amount due to Bob, cheque no.1”. Source document numbers should be included for easy reference.

This is an example of general journal.